Actionable Cyber Risk Insights for Pool Executives and Public Entities

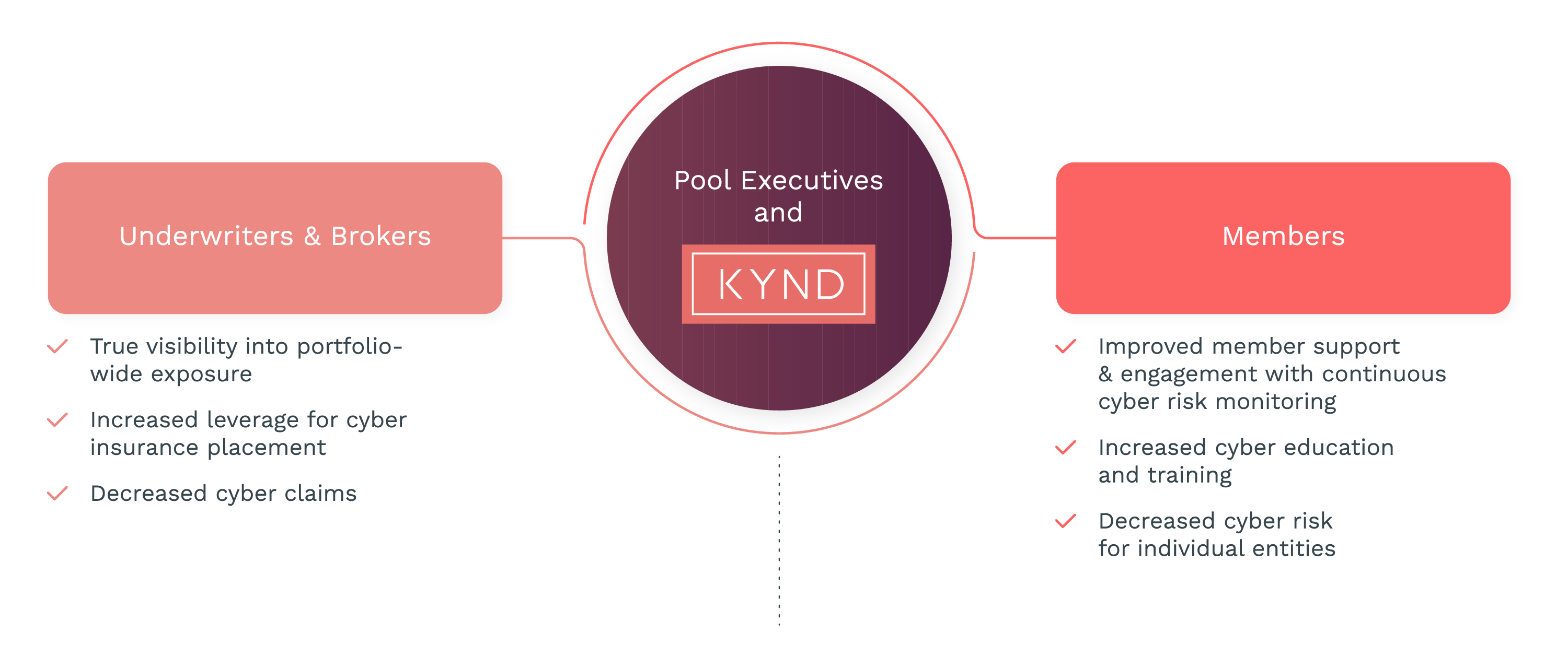

KYND is a cyber risk management solution that makes assessing, understanding, and managing cyber risk across portfolios easier and faster than ever. We provide insight into the cyber vulnerabilities you want to track—like ransomware, business email fraud, underwriting performance, and member insurability. And we do it all without any confusing technical jargon so your members can take action quickly and effectively.

Public entities are among the most common targets of cyber attacks

How KYND Supports You

Cyber Risk Control Service

- Tools for entities to manage their own risk

- Cyber 'Zero Day Event' response

- Member-tailored consultancy

Extension of Your Risk Management Practice

- Strategy for accurate insurance applications

- Industry-specific cyber education

- Triage support for high-risk entities

Underwriting Insights

- ‘Anytime’ visibility to portfolio-wide exposure

- Long-range planning benchmarks

- Prioritized signals to inform terms and conditions

Read our latest blog post

Insights and Education

Understanding the intricacies of cyber insurance is vital for public entities and risk pools. Our insights and education content are tailored to help you secure the right cyber insurance coverage for your organization. From demystifying the application process to optimizing insurability, we provide the educational resources you need to enhance your approach to cyber risk mitigation and stay ahead of the game.

See Inside the KYND Platform

"What keeps me up at night is how I get my members from 0 to 100mph when it comes to cyber risk governance and application engagement. KYND has solved this for us."

Alan Caeton, Property/Liability Program Administrator

Central California Schools Authority

"KYND's powerful combination of actionable cyber risk insights and expert advisory services enables Beazley underwriters to quickly and accurately obtain the right information they need to assess the risks and provide the right cover."

Paul Bantick, Global Head of Cyber

Beazley

Trusted By

Why KYND?

Premium Savings

On average, customers save $277K in cyber premiums per policy. Imagine that throughout your entire pool.

Actionable Results

'Red' flagged entities have 3x the cyber incidents. You and your organizations will know exactly what to do to fix potential issues.

Data-Backed Insights

Our customers see a 70% reduction in ransomware claims by premium. We never use third-party data and run fresh scans every time.

Industry-Leading Support

We monitor more than 300,000 organizations throughout our platform, and we're always available with ongoing reports, support, and more.

Ready to Talk?

Keen to learn more about themes of deficiency for your risk pool?

Discover how KYND can empower you today.